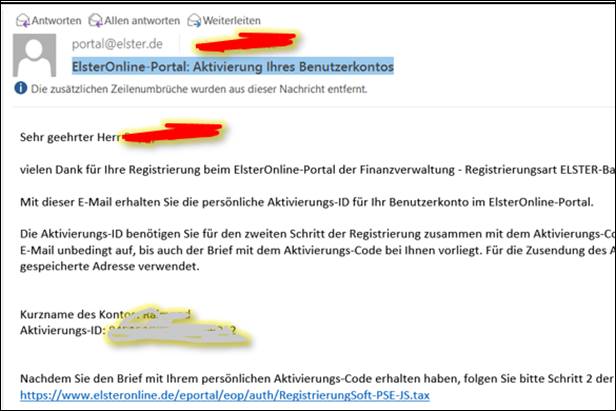

Some common jobs (such as bicycle delivery person, tour guide, cleaner, etc.) may not be classified as freelancing in Germany at all - but may actually be a Gewerbe, or trade, requiring you to get a Gewerbeschein or trade license. Please note: this guide is meant for those with straightforward freelance income (artists, teachers, writers, etc.). Since 2021, this form needs to be completed online via the ELSTER portal - or as Germany calls it, ‘Your Online Tax Office.’ This guide will help you set up a user account for the first time as well as complete the freelancer registration form. To start invoicing and collecting money in Germany, you’ll need to get a freelance Steuernummer or tax number (not the same thing as the Tax ID you received after registering your address) - and that means filling out the Fragebogen zur steuerlichen Erfassung.

0 kommentar(er)

0 kommentar(er)